Lured into Debt: How Payday Loans and Paycheck Apps Exacerbate Financial Struggles in Underserved Communities

Nyanya Browne, Ph.D.

CHURP Postdoc & Research Fellow

“Payday Lending” has a well-earned reputation as a financial system that exploits the underserved, often locking them into ever-deepening cycles of indebtedness. In response, regulators at various levels of government have attempted to control or even ban the use of such products. Still, the financial world is no stranger to evolution, and the lending landscape is no exception. The convergence of state regulations, payday loan bans, and the rise of paycheck advance apps have created a dynamic environment that is reshaping how people access short-term funds, often to their detriment. This article delves into this intricate relationship, exploring how borrowers and lenders navigate these changes, and the implications for consumer financial health.

Payday loans and state bans

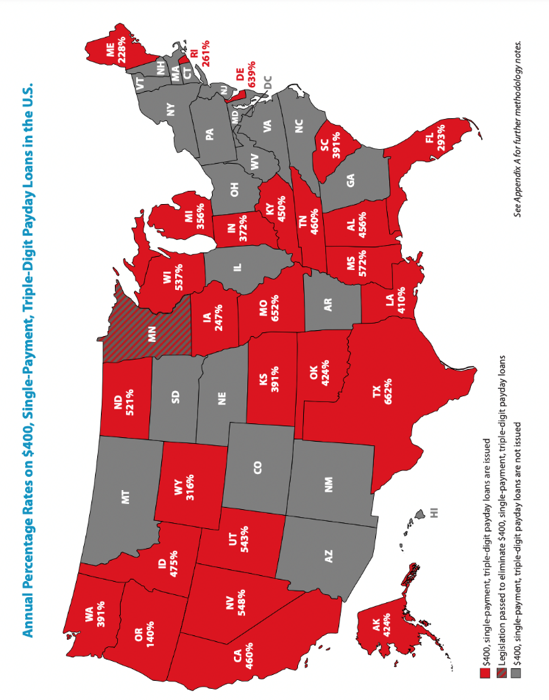

Payday lending is a financial tool designed to offer immediate relief to those facing unforeseen expenses or challenges in their income flow. It is typically a short-term, high interest loan (of $500 or less), due on one’s payday. Borrowers typically secure these loans by writing a post-dated check to the lender or providing the lender with authorization to electronically debit the funds from their bank, credit union, or prepaid card account, covering the loan amount plus interest and fees. When the borrower's payday arrives, the check is cashed or monies are automatically deducted from the borrower’s account. The Annual Percentage Rate (APR) of these loans is usually 400% or more on a typical 14-day loan (Figure 1).

Source: Center for Responsible Lending

The Federal Trade Commission tells us that certain payday lenders have used dishonesty and unlawful behavior to exploit individuals facing financial difficulties and seeking these short-term loans. Research from the Consumer Financial Protection Bureau shows that payday lenders derive 75% of their fees from borrowers who take out over 10 loans per year, highlighting their reliance on this extended cycle of indebtedness for their operational model.

The high interest rates associated with payday loans that often lead to a cycle of debt and systematic predation by such lenders prompted several states to impose strict regulations and outright bans on traditional payday loans to protect vulnerable consumers from debt cycles. Nineteen states plus the District of Colombia either restrict or prohibit payday lending. States that severely restrict high-cost payday lending have placed interest rate caps, limits on loan amounts, and requirements for loan affordability assessments. While these measures are intended to protect consumers, unscrupulous profit-maximizing lenders have responded by evading these restrictions in various ways. Regulation has perversely induced, inadvertently, a new wave of borrowing options.

Online payday lending: Incentives and deceptions

The landscape of payday lending has undergone a significant expansion with the advent of online lending platforms, introducing both convenience and new concerns. This digital shift has granted online lenders the advantage of operating with reduced overhead costs compared to their brick-and-mortar counterparts. However, this advantage does not typically translate to lower costs for borrowers. Despite the absence of physical storefronts, online lenders often impose comparable, if not higher, charges on borrowers. These elevated expenses, according to the online payday lenders, stem from factors such as customer acquisition, credit risks, and the intricacies of digital operations. But despite these different models, there appears to be no evidence of price competition between their operators, suggesting a tacit understanding among lenders that the debtor, usually in a weakened financial position to begin with, is to be fleeced as much as possible.

In the digital lending realm, enticing incentives play a pivotal role. Online lending platforms often offer rewards of up to $110 to individuals who successfully refer qualified loan applicants through lead generators1 or affiliate marketers. Additionally, borrowers may be lured by the promise of reduced rates on their initial loans. However, the pursuit of these rewards can sometimes obscure the potential pitfalls that lie ahead.

The online lending landscape veers into illegality and deception. In an increasingly interconnected world, online lenders have ventured across state lines, sometimes connecting applicants from licensed states to lead generators for states where their services are not offered. This maneuver, while maximizing their potential clientele, may cross the line legally and at least introduces regulatory complexities that underscore the need for harmonized oversight across jurisdictions.

While some online lenders present themselves as state-licensed and compliant with mandated interest rates and loan terms, a growing number of online lenders invoke legal frameworks from states without such regulations, or even from foreign jurisdictions. This trend extends to unabashedly siting payday lending locations in tribal lands, then claiming sovereign immunity based on treaties with the federal government. However, such a contentious stance has not gone uncontested. A lawsuit was brought against an online payday lender, American Web Loan, by individuals who claimed to be victimized by its predatory lending practices. The lender, asserting that it had the authority to charge exorbitant rates because it was owned by the Otoe-Missouria, a Native tribe, was accused of charging interest rates as astonishingly high as 726% for short term loans ranging from $300 to $2500. Troublingly, these rates were often inadequately disclosed during the application process, leaving borrowers blindsided by the true cost of their loans.

This modern borrowing landscape may offer convenience and accessibility, but it also demands consumer protection, regulatory oversight, and methods of enforcing laws and regulations intended to prevent the exploitation of the underserved population members facing dire financial conditions.

The emergence and appeal of paycheck advance apps

Another pivot in the payday lending world in response to regulatory regimes and bans is the rise of paycheck advance apps, which introduces an inventive and alternate approach to bridging immediate financial gaps Apps including Earnin, PayActiv, Dave, Brigit, and Rain, often offered by employers or third-party entities, facilitate early access to a portion of earned wages before the scheduled payday. These user-friendly platforms present a distinctive opportunity, enabling individuals to tap into a fraction of their upcoming salaries ahead of the usual payday timeline. In return, these apps may ask for a voluntary fee or a tip, though opting not to contribute often carries repercussions, such as limiting the amount of cash advances. Much like payday loans borrowers, a significant number of paycheck app users utilize these advances for pressing needs such as cash advances for emergency expenses as well as day-to-day payments for food, utilities and rent.

The paycheck advance apps market their sites with vibrant, cheerful, and playful visuals to captivate users. These advertisements and app interfaces, adorned with lively colors and animated characters, often create an air of approachability and ease. By adopting this fun and colorful façade, paycheck advance apps employ a strategic gimmick to entice users to sign up, especially attractive to those who might be facing financial stress. This deliberate aesthetic serves as a hook, drawing users into a seemingly effortless and enjoyable borrowing experience. However, this cheerful exterior masks yet again the frequent cycle of indebtedness associated with these products.

These apps avoid being classified as payday loans since they do not impose interest charges, dodging the regulatory scrutiny reserved for payday loans. However, some proponents argue that despite the modern appearance of earned wage access apps, they can still yield similar outcomes for consumers as traditional payday loans, as they could inadvertently contribute to a cycle of debt, as gaining early access to paycheck funds might accelerate the depletion of resources. Like traditional payday lending these apps rely on taking advantage of users' income distress and often less-than-optimal financial behaviors.

Policy implications for vulnerable and underserved communities

The evolving landscape of state bans, online lending, paycheck advance apps, and payday loans is reshaping how people from underserved communities manage financial challenges. These short-term lending avenues have brought both convenience and unintended challenges to the realm of personal finance. While the uptick in technology-driven financial solutions like paycheck apps and online payday lending offer quick access to funds and immediate financial relief, they can also encourage improper financial management among vulnerable communities. The Pew Charitable Trust’s research has identified that the groups that were disproportionately likely to use payday loans are individuals with an income of $40,000 or less, African Americans, renters, people aged 25 to 44, and parents of minor children. Moreover, users typically use short-term borrowing products to cover regular expenses such as rent, mortgage, and utilities.

The allure of quick cash and the convenience of these platforms could potentially create a cycle of dependence, wherein borrowers repeatedly resort to these options without fully understanding the long-term consequences. Many borrowers initially turn to these options out of desperation to cover bills and expenses because their income falls short. However, once they enter this financial web, lenders often entice them with incentives that entice them further into a downward spiral of insolvency. This unmanageable cycle of debt becomes a seemingly inescapable routine, where borrowers continually rely on these solutions without comprehending the enduring financial repercussions. This phenomenon accentuates the importance of tailored financial education for vulnerable communities, empowering them to make informed decisions and manage their finances prudently.

As the digital lending arena continues to evolve, evading regulation and compassion in an unforgiving exploitation of poor people, it becomes increasingly vital for regulators, policymakers, and consumers to safeguard the financial well-being of borrowers. Policymakers should consider implementing comprehensive regulations that address the unique challenges posed by these technologies. Striking a balance between technological innovation and consumer protection is crucial to ensuring that vulnerable communities are not exposed to financial risks due to the allure of convenient but potentially harmful financial solutions.

Endnotes

1Lead generators are often third-party entities that gather information from potential borrowers and then connect them with online lenders who may be able to fulfill their borrowing needs. They create a bridge between those seeking loans and financial institutions that can provide them.

References

- Butler, Michael. (2021). Advocates Say Paycheck Advance Apps Continue Cycles of Poverty. https://nextcity.org/urbanist-news/advocates-say-paycheck-advance-apps-continue-cycles-of-poverty

- Center for Responsible Lending. (2023). Red Alert: Payday Rates and Rate Caps in the United States. https://www.responsiblelending.org/sites/default/files/nodes/files/research-publication/crl-red-alert-rates-payday-ratecap-map-jun2023.pdf

- Consumer Federation of America (CFA). (2011). CFA Survey of Online Payday Loan Websites. https://consumerfed.org/pdfs/CFAsurveyInternetPaydayLoanWebsites.pdf

- Consumer Financial Protection Bureau. (2017). CFPB Finalizes Rule to Stop Payday Debt Traps. https://www.consumerfinance.gov/about-us/newsroom/cfpb-finalizes-rule-stop-payday-debt-traps/

- ______. (2022). What is a payday loan? https://www.consumerfinance.gov/ask-cfpb/what-is-a-payday-loan-en-1567/

- ______. (2013). Payday Loans and Deposit Advance Products: A White Paper of Initial Data Findings. https://files.consumerfinance.gov/f/201304_cfpb_payday-dap-whitepaper.pdf

- Federal Trade Commission. (n.d.). Payday Lending. https://www.ftc.gov/news-events/topics/consumer-finance/payday-lending

- Goldberg, Ryan. (2021). How a Payday Lender Partnered with a Native Tribe to Bypass Lending Laws and Get Rich Quick. The Intercept. https://theintercept.com/2021/05/31/payday-lender-native-american-tribe-american-web-loan/

- Hardy, Adam. (2021). Cash-Advance Apps Court Users with Cute Mascots and Fast Payments — but Beware of the High Costs. https://money.com/cash-advance-apps-payday-loans-fees/

- Payday Loan Information for Consumers. (n.d.). How Payday Loans Work https://paydayloaninfo.org/how-payday-loans-work/#:~:text=Payday%20loans%20range%20in%20size,to%20%2430%20to%20 borrow%20%24100.

- ______. State Information. https://paydayloaninfo.org/state-information/

- Pew Charitable Trusts. (2014). Fraud and Abuse Online: Harmful Practices in Internet Payday Lending. https://www.pewtrusts.org/en/research-and-analysis/reports/2014/10/fraud-and-abuse-online-harmful-practices-in-internet-payday-lending

- United States District Court Eastern District of Virginia. (2019). Solomon v. American Web Loan, Inc. et al - Second Amended Class Action Complaint. https://buckleyfirm.com/sites/default/files/Buckley%20InfoBytes%20-%20Solomon%20v.%20American%20Web%20Loan%2C%20Inc.%20et%20al%20-%20Second%20Amended%20Class%20Action%20Complaint%202019.02.15.pdf